additional tax assessed meaning

Tax return Tax law. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

What Is A Homestead Exemption And How Does It Work Lendingtree

Definition and Example of a Property Tax Assessment.

. Your property tax bill begins with an assessment of your propertys fair market value. February 6 2020 437 PM. Year of Assessment 2022 is for income earned from 1 Jan 2021 to 31 Dec 2021.

The 10000 tax is automatically assessed and constitutes a tax debt of the taxpayer despite only a partial payment. The assessors market assessed value is based on actual historical sales of similar properties for a specified study period. The term additional assessment means a further assessment for.

For TEFRA cases see CCDM 359352. This number is called your tax assessment. Posted on Apr 28 2015.

Tax is an amount of money that you have to pay to the government so that it can pay for. As to why it was. Yesterday I finally took all the courage opened the IRS letter that was sent to mynew address by the end of June 2021 then logged into my IRS account.

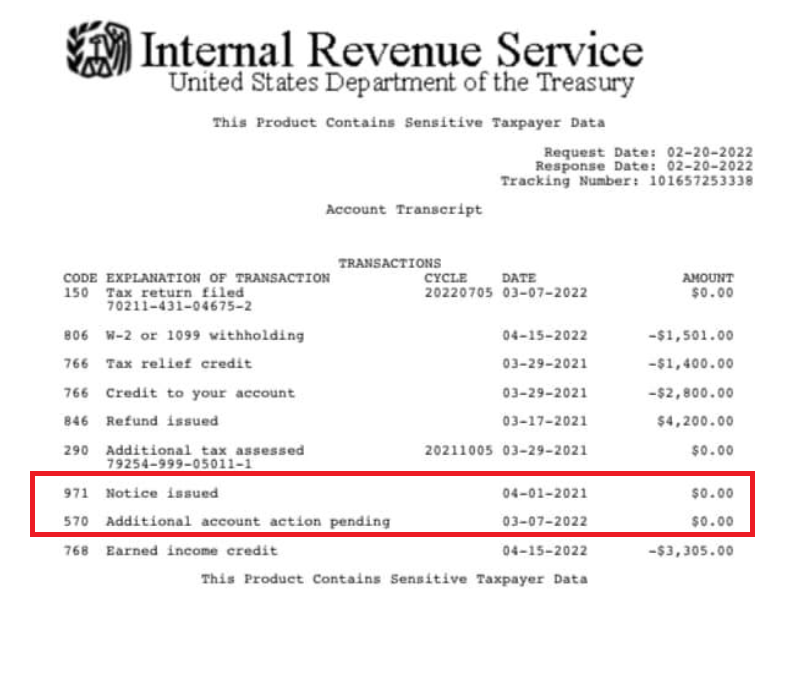

Related Entity in respect of a person means any person who is an associate of that person under section 318 of the Income Tax Assessment Act 1936. The 20201403 on the transcript is the Cycle. Tax Penalty 280 IB D Bad Check Penalty 281 IB C Abatement of Bad Check Penalty 286 IB D Bad Check Penalty 287 B C Reversal of Bad Check Penalty 290 IB D Additional Tax Assessment 291 IB C Abatement Prior Tax Assessment 294 IB D Additional Tax Assessment with Interest Computation Date 295 IB C Abatement of Prior Tax Assessment with Interest.

Ask a lawyer - its free. IRS code 290 additional tax assessed which resulted in big amount owed. It may be disputed.

This refers to the tax year in which your income tax is calculated and charged. It is a further assessment for a tax of the same character previously paid in part. What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance. For a detailed discussion of appeals see CCDM Part 36. The timing of an assessment after a decision is entered depends on whether an appeal is filed.

A month later I request a transcript and it gave me code 290 additional tax assessed on the same date I requested the transcript. I was accepted 210 and no change or following messages on Transcript since. I dont understand what additional tax assessed means.

Assesses additional tax as a result of an Examination or Collection Adjustment to a tax module which contains a TC 150 transaction. I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. The following is an example of a case law which defines an additional assessment.

Market assessed value. Additional Tax or Deficiency Assessment by Examination Div. Generates TC 421 to release 42 Holdif Disposal Code 1-5 8-10 12 13 34 and TC 420 or 424.

Accessed means that the IRS is going through your tax return to make sure that everything is correct. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. Just sitting in received.

The assessment is for income you have earned in the preceding calendar year. Examples of Tax Assessment in a sentence. 23 July 2013 at 1015.

I filed an injured spouse from and my account was adjusted. Additional Assessment Law and Legal Definition. Please excuse any confusion or grammatical errors since English isnt my first language.

The meaning of code 290 on the transcript is Additional Tax Assessed. Certificates of exemption from tax Debits Tax. Meaning pronunciation translations and examples.

It means that your return has passed the initial screening and at least for the moment has been accepted. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Additional assessment is a redetermination of liability for a tax.

Additional information that may be obtained from this transcript is the date and amounts of additional payments made by the taxpayer penalties that were assessed and if the return was previously. Additional tax assessed basically means that IRS did not agree with the original amount assessed and. Code 290 is indeed an additional tax assessment.

Finally the number 03 is the Process Day of the week. The number 14 is the IRS Cycle Week. The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to determine your tax bill.

Do i have to pay this or can it be disputed. IRS code 290 with 000 basically means a freeze or hold has been lifted. The Plan is a plan to which Subdivision 83A-C of the Income Tax Assessment Act 1997 Cth applies subject to conditions in the Act.

There is a distinction between your assessed value and. In this case the IRS would seek to collect the balance due 5000 from the. This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question.

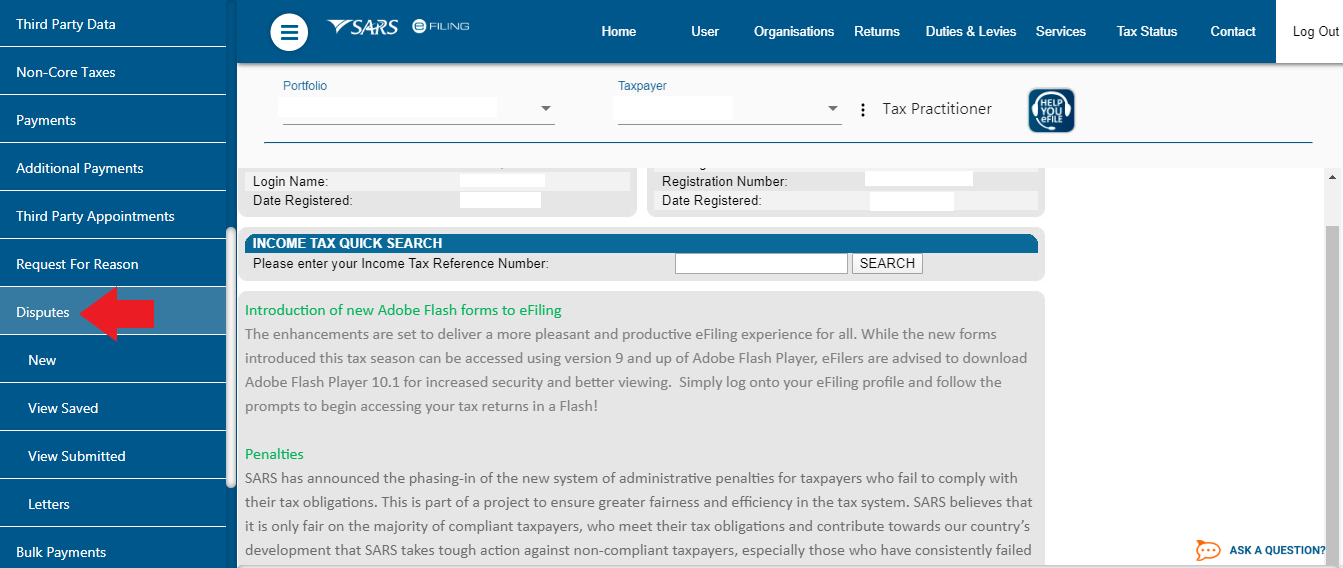

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment. 575 rows Additional tax assessed by examination. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due.

Taxes are then calculated on this basis at a rate set by the taxing authority for all homes and properties in a given area sometimes called a multiplier or mill rate. You can also request a statement of account from the SARS correspondence tab and click on historic IT notices to see your overall balance. In non-TEFRA cases the taxpayer is mailed a notification that a tax plus interest and additions and penalties if any is due and a demand for payment.

Upon looking into my account online I found that I have been charged code 290 Additional tax assessed 240. Approved means they are preparing to send your refund to your bank or directly to you in the mail. Code 290 Additional Tax Assessed on transcript following filing in Jan.

From the cycle 2020 is the year under review or tax filing.

Understanding California S Property Taxes

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest

Your Property Tax Assessment What Does It Mean

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Secured Property Taxes Treasurer Tax Collector

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

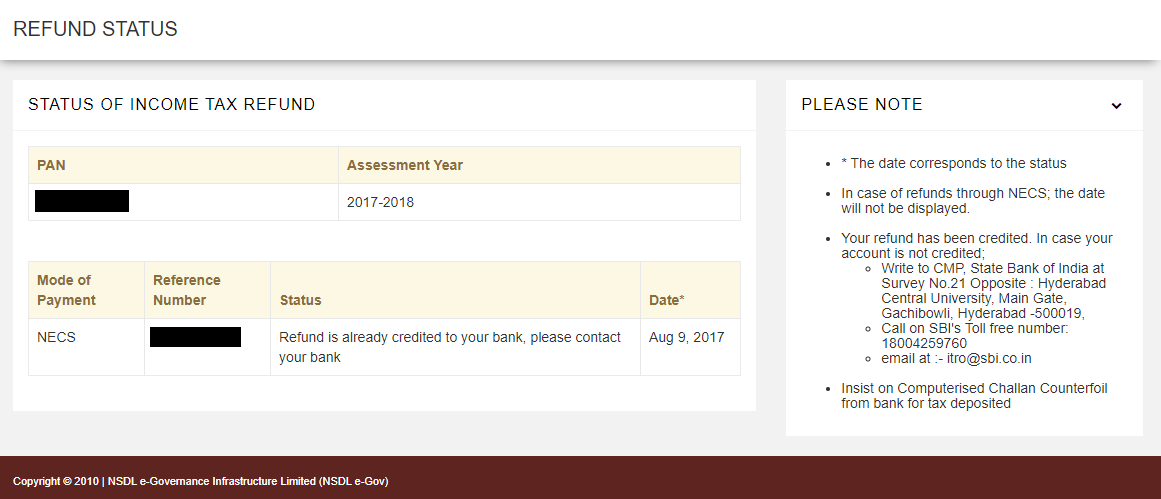

Income Tax Refund How To Check Claim Tds Refund Process Online

Types Of Income Tax Assessment Objectives Time Limits Legalraasta

Your Tax Assessment Vs Property Tax What S The Difference